An Innovative

Investment Vehicle for the Renewables Sector

The management of

Solar Flow-Through Funds has developed an innovative investment

vehicle for Canadian Accredited Investors. Based on the Flow-Through concept for mineral exploration, the Solar Flow-Through Limited Partnerships provide income tax deduction benefits similar to those of mineral exploration. We use these funds to invest in solar power projects that have been qualified under the Ontario’s Independent Energy System Operator (IESO) Feed-in-Tariff (FIT) program.

Funding & Assistance for Solar Developers

We also work with qualified solar project developers to provide funding and joint

venture or equity opportunities, plus expertise, contacts and

guidance at all levels of the government process. If you are a solar

developer seeking funding, projects or assistance with Ontario’s FIT

program application process, contact us and we can help you move

ahead.

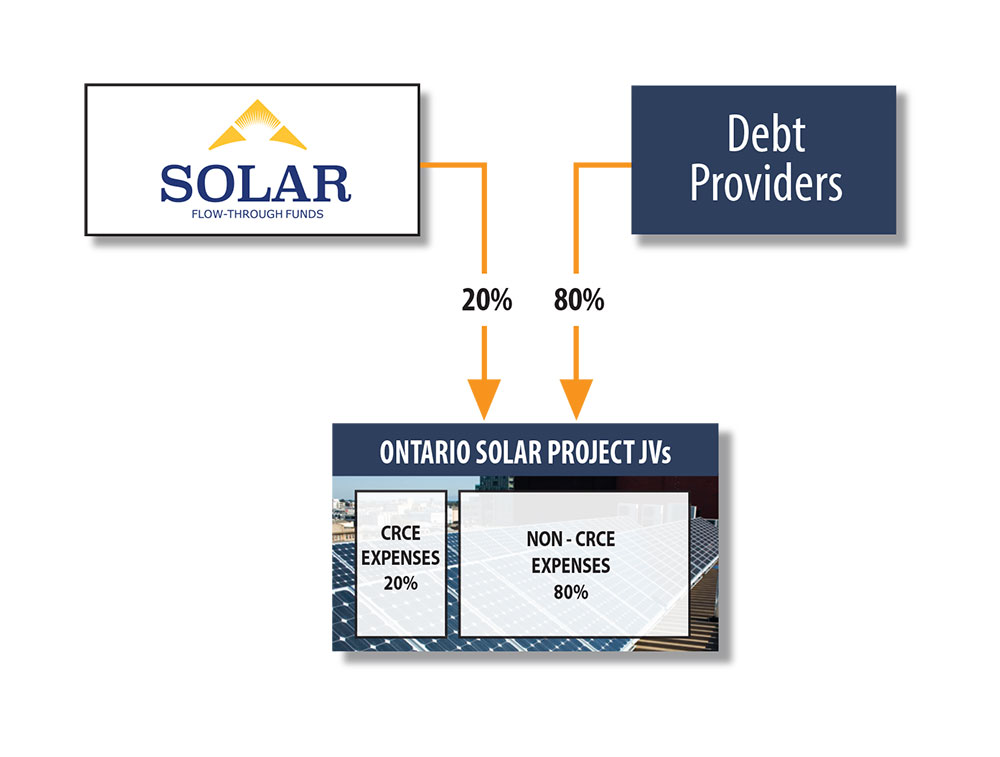

Funding Structure

Solar Flow Through Limited Partners’ investments provide approximately 20% of the

capital costs of each project we fund. These expenses are expected to

qualify as Canadian Renewable Conservation Expenses (CRCE). The

common shares of the Subsidiary Companies purchased by the

Partnership are expected to constitute “flow-through shares”

for the purposes of the Tax Act. The 80% balance of construction

costs would be funded through debt provided by banks, other

institutions and/or project developers. The diagram below helps

illustrate our funding structure: